Key Facts

There is an old proverb that haunts the hallways of family enterprises around the world: “From shirtsleeves to shirtsleeves in three generations.” The saying suggests that the first generation builds the wealth, the second stewards it, and the third—burdened by complexity and distance from the founding spark—unintentionally consumes it.

But statistics are not destiny. While it is true that a significant percentage of family businesses struggle to transition past the cousin consortium stage, the ones that thrive do not survive by accident. They survive by evolution.

For the third generation, the “kitchen table” style of decision-making that served the founders so well often becomes a bottleneck. The challenge isn’t a lack of passion; it is usually a lack of structure capable of handling complex family dynamics alongside competitive business demands. This is where the concept of professionalization enters the conversation—not as a way to push the family out, but as a mechanism to keep the business strong enough to keep the family in.

At the heart of this transformation lies the implementation of independent board governance. It is a step that feels risky to many families—inviting “outsiders” into the inner sanctum—but when architected correctly, it is the bridge between a fragile legacy and an enduring institution.

Understanding Professionalization and Independent Governance

Before diving into logistics, we must dismantle a common myth: Professionalization does not mean replacing family leadership with “corporate suits.”

True professionalization is about shifting from personality-driven management to process-driven governance. It involves creating systems where decisions are made based on merit and strategy rather than hierarchy or emotion.

The Role of the Independent Director

In a family business context, an independent director is a board member who is neither a family member nor an employee of the company. They have no financial or emotional ties to the “family drama,” allowing them to offer something the family often cannot generate internally: pure, unadulterated objectivity.

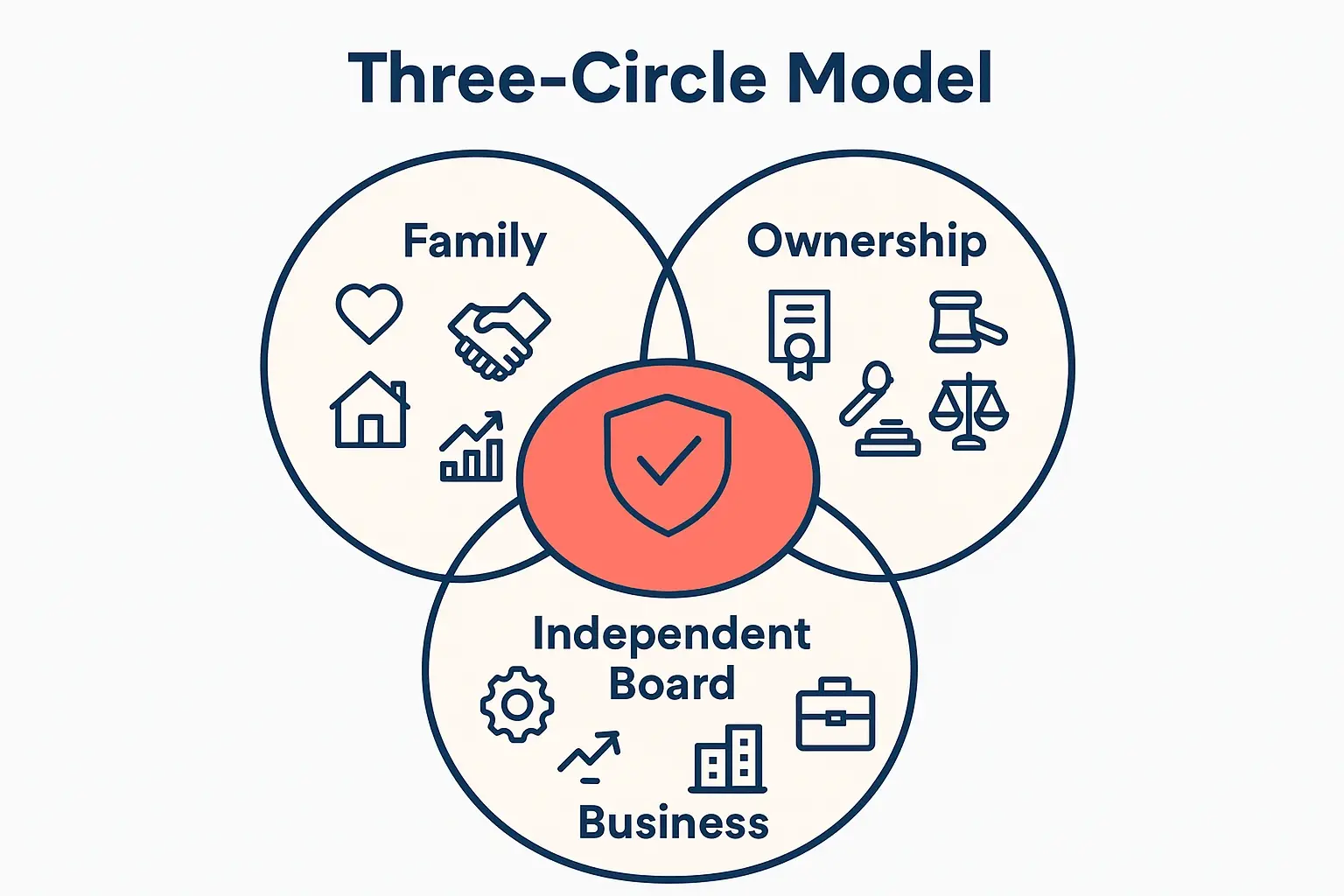

For a third-generation business, where ownership is often diluted among various cousins with different levels of involvement, independent directors serve as the “fair witness.” They help balance the often competing interests of the Three-Circle Model (Family, Business, and Ownership), ensuring that one circle doesn’t cannibalize the others.

The Unique Challenge of the Third Generation

Why is this specifically critical for the third generation?

- Complexity of Ownership: You likely have active owners (working in the business) and passive owners (enjoying dividends). Their incentives often diverge.

- The “Familiarity Trap”: When you have known your CFO since they were in diapers because he is your cousin, it is incredibly difficult to hold him accountable for missed KPIs.

- Succession Ambiguity: Choosing a successor from a pool of ten cousins is exponentially harder than choosing between two siblings.

An independent board acts as a stabilizing force, removing the emotional volatility from these high-stakes decisions.

A Blueprint for Implementation

Building a professional board is a journey, not a transaction. Research and observation of successful transitions suggest a phased approach.

Phase 1: The Readiness Assessment

Before recruiting, the family must look inward. Is the family ready to be challenged? If the current leadership views a board merely as a “rubber stamp” for their ideas, the process will fail. The family assembly or council must align on the desire for accountability. This is a core tenant of the philosophy at the integral institute, where clear vision and shared goals are prerequisites for effective team transformation.

Phase 2: Codifying the “Family Way”

Independent directors need a compass. The family must define its values and vision explicitly. What are the non-negotiables? Is the goal aggressive growth or legacy preservation? This “Constitution” guides the board, ensuring that professionalization doesn’t dilute the unique culture that gave the business its competitive advantage.

Phase 3: Structural Design

You must determine the board’s mandate. Will it be fiduciary (with legal voting power) or advisory? For many families beginning this journey, an advisory board is a safe “training wheels” stage. However, true accountability usually comes with a fiduciary board.

Phase 4: Selecting “Ambidextrous” Directors

This is the most critical step. You aren’t just looking for a resume; you are looking for emotional intelligence.

- The Skill Set: You need hard skills that the family lacks (e.g., M&A experience, digital transformation, international expansion).

- The Mindset: You need what researchers call “ambidextrous directors”—individuals who are rigorous about business performance but deeply empathetic to “socio-emotional wealth” (the non-financial value the family derives from the business).

Phase 5: Onboarding and Integration

Dropping a corporate veteran into a family business without context is a recipe for culture shock. A structured onboarding process should include deep dives into the family history, meeting key stakeholders, and understanding the unspoken dynamics of the ecosystem.

Navigating the Emotional Landscape

The technical side of governance is straightforward; the human side is where the work lies. The biggest hurdle to implementing independent governance is rarely financial—it is the fear of losing control.

It is vital to understand that an independent board does not strip the family of ownership. The family retains the power to elect the board. Instead, the board serves the ownership by holding management accountable.

Preserving the Core

A common anxiety is that professionalization means the business will lose its soul—the “family feel” that customers and employees love. This often stems from a misunderstanding of governance. Good governance clarifies the distinction between “family values” and “family employment.” It ensures the values permeate the organization, even if a family member isn’t in every single operational seat.

Leaders in this space, such as sami bugay, often emphasize that transforming an organization requires a holistic approach—integrating the mind, heart, and spirit of the leadership team. An independent director who understands this can help the family distinguish between a tradition that serves the business and a habit that holds it back.

Common Pitfalls to Avoid

Even with good intentions, families often stumble.

- The “People Potpourri”: Filling the board with the CEO’s golf buddies or the family attorney. These individuals lack true independence and will struggle to ask the hard questions.

- Paper Processes: Creating committees and charters that look great in a binder but are ignored in practice. Governance is a behavior, not a document.

- Diluted Distinctiveness: Copying a public company’s governance structure verbatim. Your governance must be tailored to your specific ownership structure and family maturity.

Frequently Asked Questions

What is the difference between a Family Council and a Board of Directors?

A Family Council manages the family (education, harmony, relationship to the business), while the Board of Directors manages the business (strategy, CEO oversight, performance). The Board serves the business; the Council serves the family.

Can we just have an Advisory Board?

Yes, an advisory board is an excellent starting point. It provides non-binding advice. However, because their advice can be ignored without consequence, it may lack the “teeth” necessary for serious strategic pivots or holding a family CEO accountable.

How much do independent directors cost?

Compensation varies significantly by company size and complexity, but you should expect to pay a retainer plus meeting fees. The investment should be viewed against the value of strategic risk mitigation—one avoided bad decision or one successful strategic insight usually pays for the board for years.

Will independent directors understand our “Family Culture”?

Only if you select for it. This is why “cultural fit” is just as important as financial acumen. The best directors for family businesses are often those who have served on other family boards and respect the unique stewardship aspect of private ownership.

Moving Forward

Implementing independent governance is perhaps the most significant signal a third-generation family can send that they are committed to the future. It transforms the business from a personal fiefdom into a professional institution capable of outlasting its current leaders.

It requires courage to invite scrutiny, but that scrutiny is precisely what polishes the diamond. As you consider the longevity of your enterprise, remember that the goal is not just to keep the business in the family, but to ensure the business is worth keeping. By exploring the comprehensive approaches to leadership and team development found at the integral institute, families can find the frameworks necessary to navigate this complex but rewarding transition.