Imagine Sunday dinner. The conversation flows easily between personal updates, memories of the founder, and the shared history that binds the family together. Now, imagine Monday morning in the boardroom. The same people are present, but the air is different. The pressure to innovate, the need to hit quarterly targets, and the challenge of managing non-family executives create a palpable tension.

For 2nd and 3rd generation C-Suite leaders, this isn’t just a scenario—it is the defining challenge of their tenure. You are tasked with a dual mandate that often feels contradictory: stewarding the intangible “soul” of the family legacy while simultaneously driving the hard, quantitative performance required to survive in a global market.

Many leaders in this position feel they must choose between being a “family-first” organization or a “performance-first” business. But the most successful multi-generational firms know this is a false dichotomy. The secret to longevity lies not in choosing one over the other, but in integrating them into a single, cohesive system.

Decoding the Family Business DNA

To navigate this landscape, we must first understand the unique ecosystem in which you operate. Unlike standard corporations, family businesses operate within the “Three-Circle Model,” where three systems overlap: Family, Business, and Ownership.

In the first generation, these circles are often entirely overlapping—the founder is the family, the owner, and the manager. But by the second and third generations (the “Sibling Partnership” or “Cousin Consortium” stages), these circles drift apart. You might have shareholders who don’t work in the business, family members who are employees but not owners, and non-family executives running the C-Suite.

The Hidden Asset: Socioemotional Wealth (SEW)

Traditional business schools teach us to maximize financial wealth. However, family businesses also possess “Socioemotional Wealth” (SEW). This includes the family’s identity, their ability to exercise influence, and the desire to pass the legacy to the next generation.

The friction often arises when standard performance metrics threaten this SEW. For example, a decision to automate a factory might make perfect financial sense (Business circle) but violates a family value of providing local employment (Family circle).

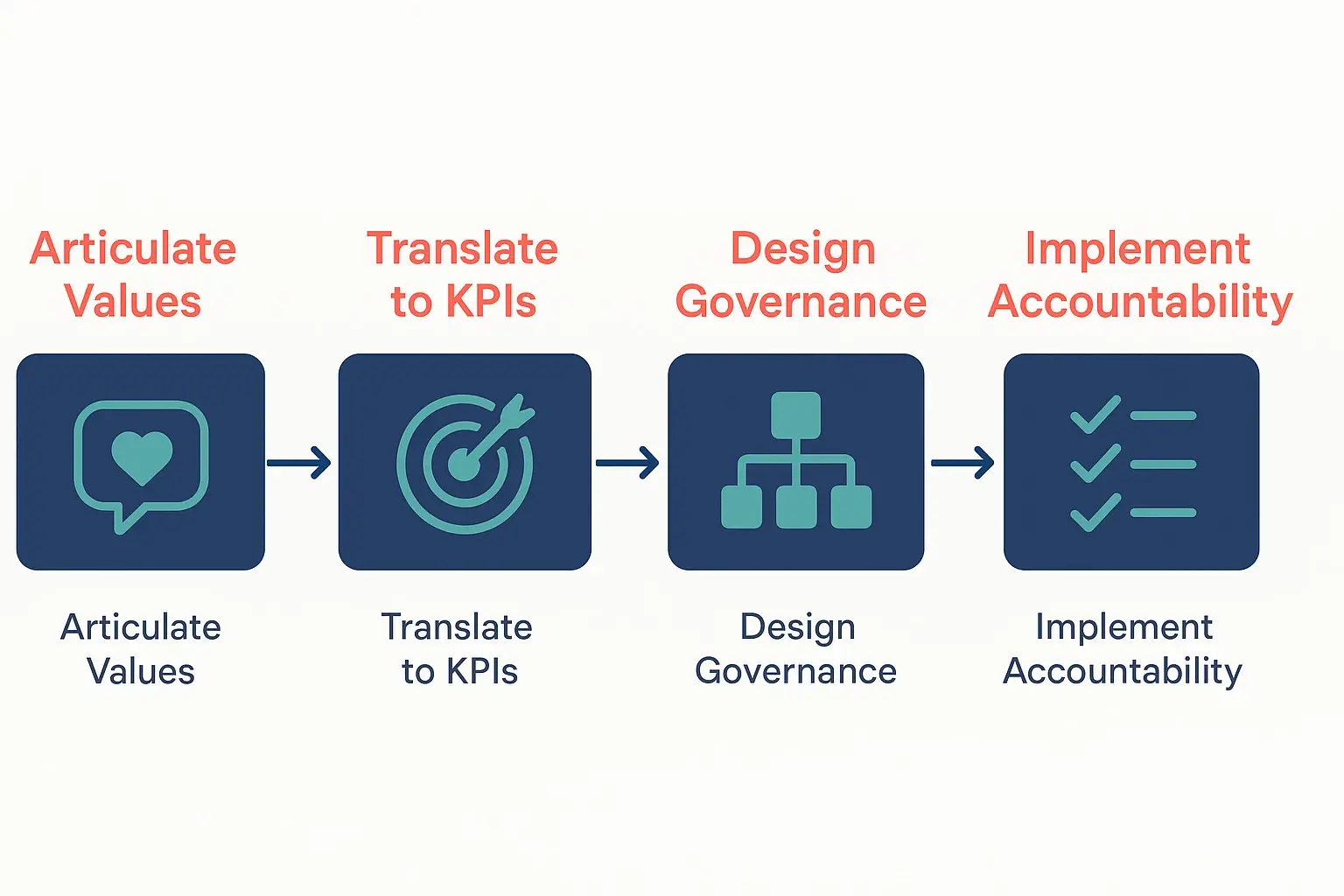

The goal of integral leadership in this context is not to ignore SEW, but to quantify it. When we treat family values as “soft” or “unmeasurable,” they inevitably clash with “hard” financial KPIs. The solution is to make the values just as concrete as the profit margins.

The Values-Driven Performance Integration (VDPI) Framework

How do you move from abstract values like “Integrity” or “Care” to a spreadsheet that a CFO can respect? It requires a deliberate shift from alignment (saying we agree) to integration (building it into the system).

This process is critical for 3rd generation leaders who may be managing cousins or facing scrutiny from an expanded shareholder base. You cannot rely on the informal authority that the founder possessed. You need a transparent system.

Step 1: Generational Redefinition

Values are static words, but their application must evolve. “Hard Work” to the founder might have meant 14-hour days on the factory floor. To the 3rd generation, “Hard Work” might mean smart innovation and global expansion.

Before setting metrics, the C-Suite and Family Council must agree on the current definition of their values. This is often called the “Generational Redefinition” exercise. For instance, the Anderson Family Industries (a well-documented case) successfully redefined “Simplicity” from “frugality” to “streamlined decision-making,” allowing them to modernize without losing their soul.

Step 2: Translating Values into KPIs

Once values are defined, they must be translated into Key Performance Indicators (KPIs). This is where the magic happens.

- Value: Stewardship.

- Traditional Metric: Net Profit.

- Integrated Metric: Debt-to-Equity ratio (risk management) and Carbon Footprint reduction (environmental stewardship).

- Value: Respect/Family Feel.

- Traditional Metric: Labor cost percentage.

- Integrated Metric: Employee retention rates, eNPS (Employee Net Promoter Score), and equitable pay audits.

- Value: Innovation.

- Traditional Metric: R&D Spend.

- Integrated Metric: Percentage of revenue from products launched in the last 3 years (showing that the spirit of entrepreneurship is alive).

By placing these on the same dashboard as EBITDA, you signal that these values are non-negotiable business objectives.

Navigating the Human Element: Governance and Accountability

Implementing these metrics requires more than just software; it requires executive presence and influence. 2nd and 3rd generation leaders often struggle to hold family members accountable because business critiques can feel like personal attacks.

This is where formal governance structures become your safety net. By separating the “Family” governance from the “Business” governance, you create a safe space for both emotional connection and professional rigor.

The Role of the Independent Board

For 3rd generation businesses, an independent board is often the difference between stagnation and growth. Independent directors can ask the hard questions about performance that family members might avoid to “keep the peace.” They ensure that the KPIs established in the VDPI framework are actually being met.

Meritocracy for Family Members

One of the most sensitive areas is the employment of family members. A robust framework suggests:

- Clear Entry Criteria: Family members should meet the same educational and experience requirements as non-family hires.

- Objective Reviews: Family employees should receive standard performance reviews based on the integrated metrics.

- Development Plans: Utilizing tools like the 4 elements of emotional intelligence can help family members understand their natural strengths and gaps, creating a development path that serves both the individual and the business.

Common Misconceptions That Hold Leaders Back

Myth: “Metrics kill the family culture.”Reality: Ambiguity kills culture. When expectations are unclear, favoritism is suspected. Objective metrics—especially those that measure values—actually protect family relationships by removing subjectivity from the conversation.

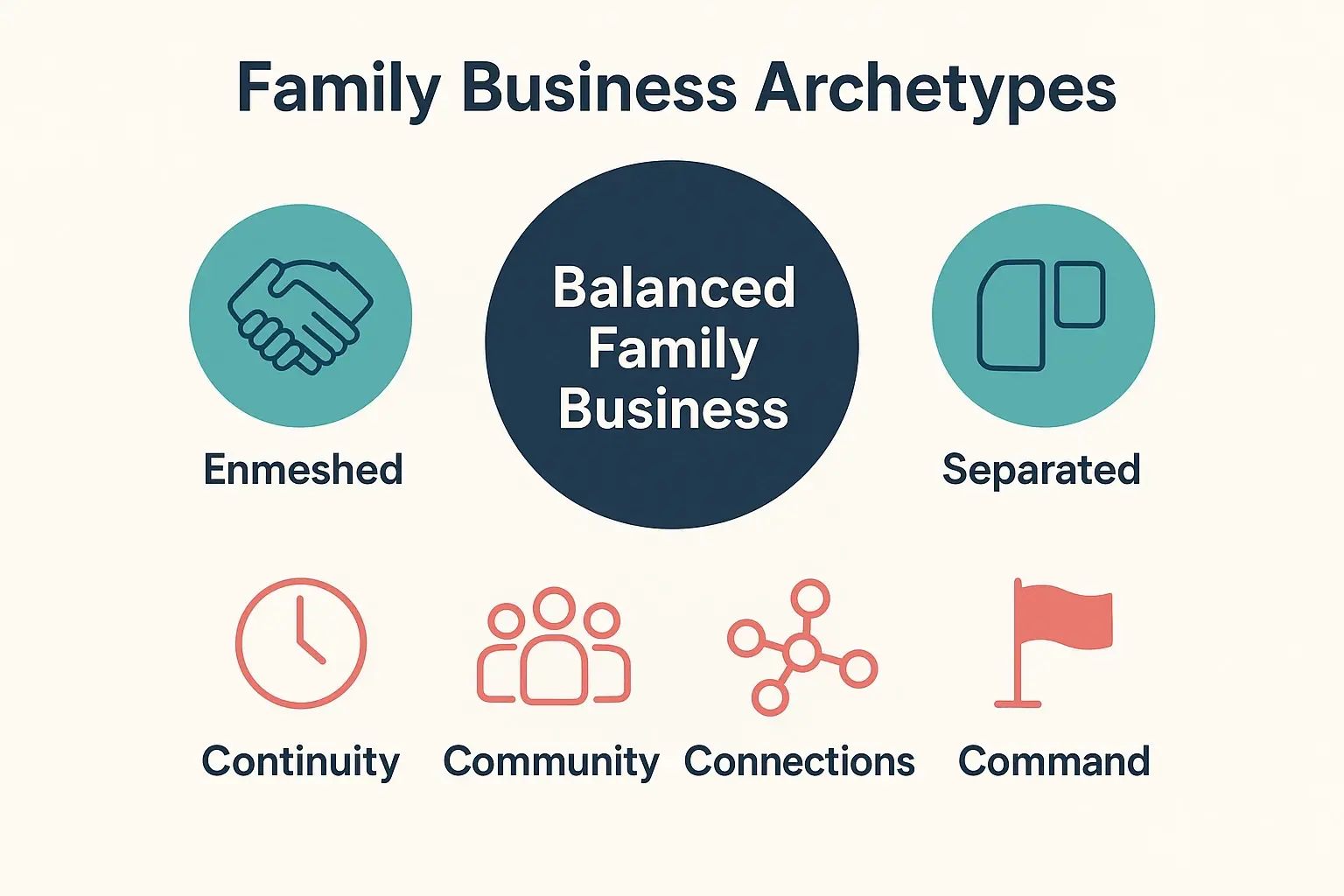

Myth: “We can’t be as profitable as non-family firms because we care too much.”Reality: Research consistently shows that “Balanced” family firms (those that successfully integrate values and professional management) often outperform their non-family counterparts in longevity and profitability. Your values are a competitive advantage, leading to higher loyalty and longer-term strategic thinking.

Myth: “The 3rd Generation just wants to spend the money.”Reality: While this is a fear, many 3rd generation leaders are highly educated and deeply committed to “re-founding” the business. They simply need a framework that allows them to contribute their modern skills while honoring the legacy.

Frequently Asked Questions

How do we start implementing performance metrics without upsetting the older generation?

Start by framing metrics as “stewardship tools.” Explain that to protect the legacy for the 4th generation, the business must remain competitive today. Use the “Generational Redefinition” exercise to show that you aren’t changing the values, but rather finding new ways to measure and protect them.

What if a family member in the C-Suite consistently misses their targets?

This is why the Governance structure is vital. The feedback should come through the formal professional channels (e.g., the Board or a non-family CEO), referencing the agreed-upon KPIs. If the metrics are clear and values-aligned, the conversation shifts from “You are failing the family” to “This role requires specific outcomes we aren’t seeing.”

Can we really measure things like “Legacy” or “Community”?

Yes. “Legacy” can be measured by brand reputation scores or the successful transition of knowledge to the next generation. “Community” can be measured by local economic impact, charitable engagement hours, or stakeholder surveys. If it matters, it can be measured.

The Path Forward

Balancing family values with performance metrics is not a problem to be solved once, but a dynamic tension to be managed continuously. For the 2nd and 3rd generation leader, success isn’t about choosing between the heart of the family and the head of the business. It is about building a nervous system—a set of integrated metrics and governance structures—that connects the two.

By defining your values, translating them into action, and holding everyone accountable to that standard, you don’t just preserve the fire of the founding generation—you add your own fuel to it, ensuring it burns brighter for decades to come.