Key Facts

Imagine a typical Sunday evening dinner. Three generations of a family are gathered, discussing the future of the business their grandfather built fifty years ago. There is passion, history, and a deep emotional connection to the company’s name.

Now, cut to Monday morning in the boardroom. The Chief Operating Officer (COO) and Chief Financial Officer (CFO)—both highly skilled professionals recruited from top multinational firms—are reviewing the quarterly projections. They are brilliant at execution, but they weren’t at that dinner. They don’t carry the childhood memories of the factory floor or the unspoken vows to preserve the family reputation.

This disconnect represents the single greatest missed opportunity in modern family enterprises.

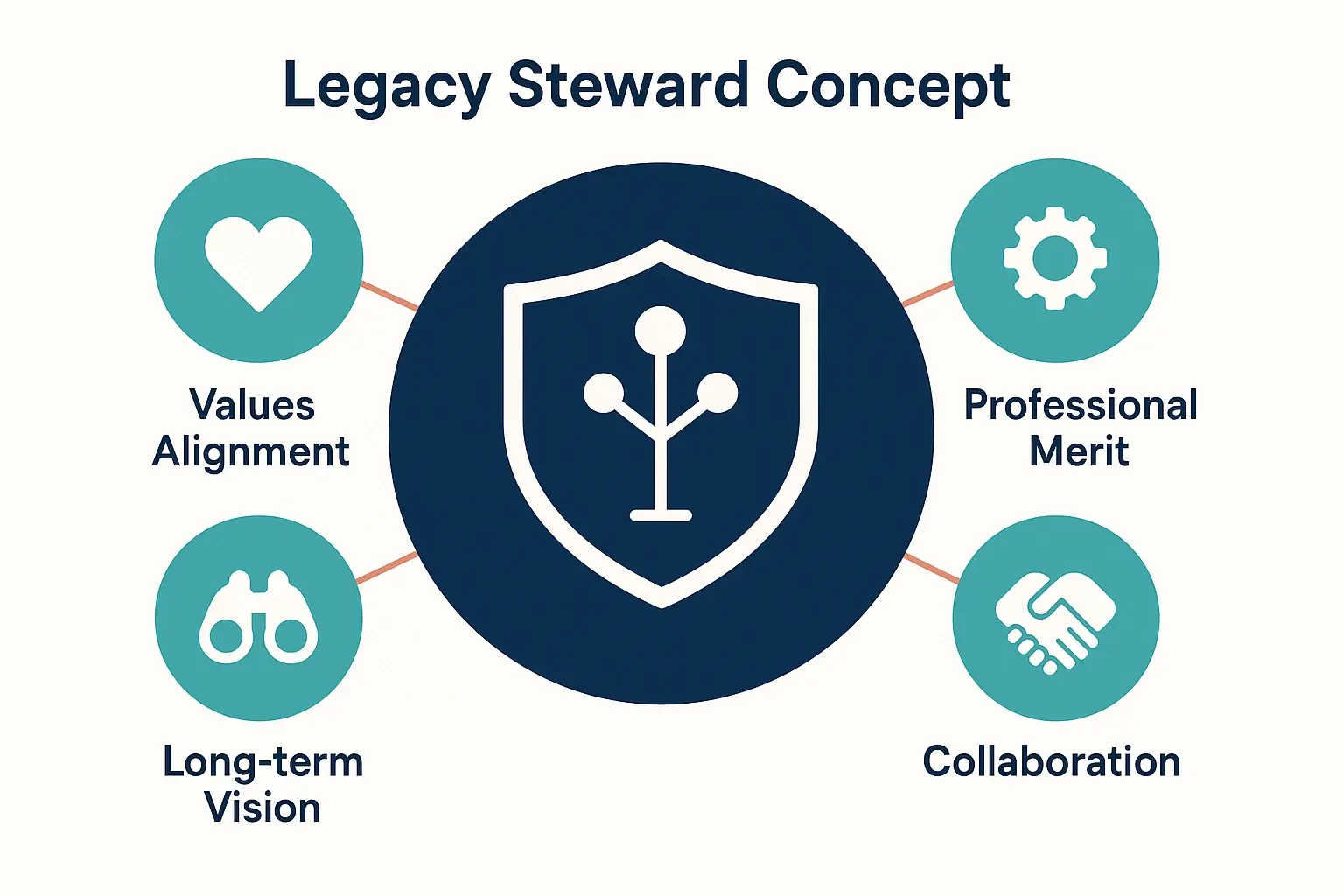

For decades, the narrative has been about “hiring outsiders” to professionalize the business. But in today’s complex economic landscape, viewing non-family executives merely as hired guns for operational efficiency is a strategic error. To truly thrive across generations, family businesses must transform these leaders into Legacy Stewards—partners who are as committed to the family’s values and long-term vision as the family itself.

Beyond the Paycheck: The “Legacy Co-Creation” Concept

The traditional view of succession planning often creates a silo: the family handles the “legacy” (values, philanthropy, ownership succession), while the non-family C-suite handles the “business” (strategy, P&L, market share).

However, research into successful multi-generational firms suggests a different approach: Legacy Co-Creation. This is the understanding that non-family executives, when properly engaged, can actually strengthen the family identity rather than dilute it. They bring an objectivity that allows them to see how family values can be operationalized in ways family members, who may be too close to the picture, might miss.

But how do you bridge the gap between bloodline and bottom line? It requires a shift from viewing non-family talent as employees to viewing them as partners in purpose-driven action.

Phase 1: Recruitment for “Legacy Fit”

Most executive searches focus on competency: Can this person scale the business? While crucial, this metric ignores the specific cultural nuances of a family firm. Engaging non-family talent begins long before the employment contract is signed.

To find a true Legacy Steward, the recruitment process must pivot to assess cultural alignment. This isn’t just about “getting along”; it’s about deep resonance with the founding mission.

- The Narrative Test: Instead of just asking about past achievements, ask candidates to interpret your founding story. How do they see that history influencing future innovation?

- Values in Action: Look for evidence of integral leadership and coaching in their past roles. Have they mentored others? Have they made difficult decisions that prioritized long-term reputation over short-term gain?

When you hire for legacy fit, you are signaling that the “soft” assets of the family—its reputation and values—are just as important as the hard assets.

Phase 2: Structural Integration and Governance

Once the right talent is in the room, the challenge shifts to integration. A common friction point arises when non-family executives feel excluded from the “real” decisions made at the family barbecue rather than the boardroom table.

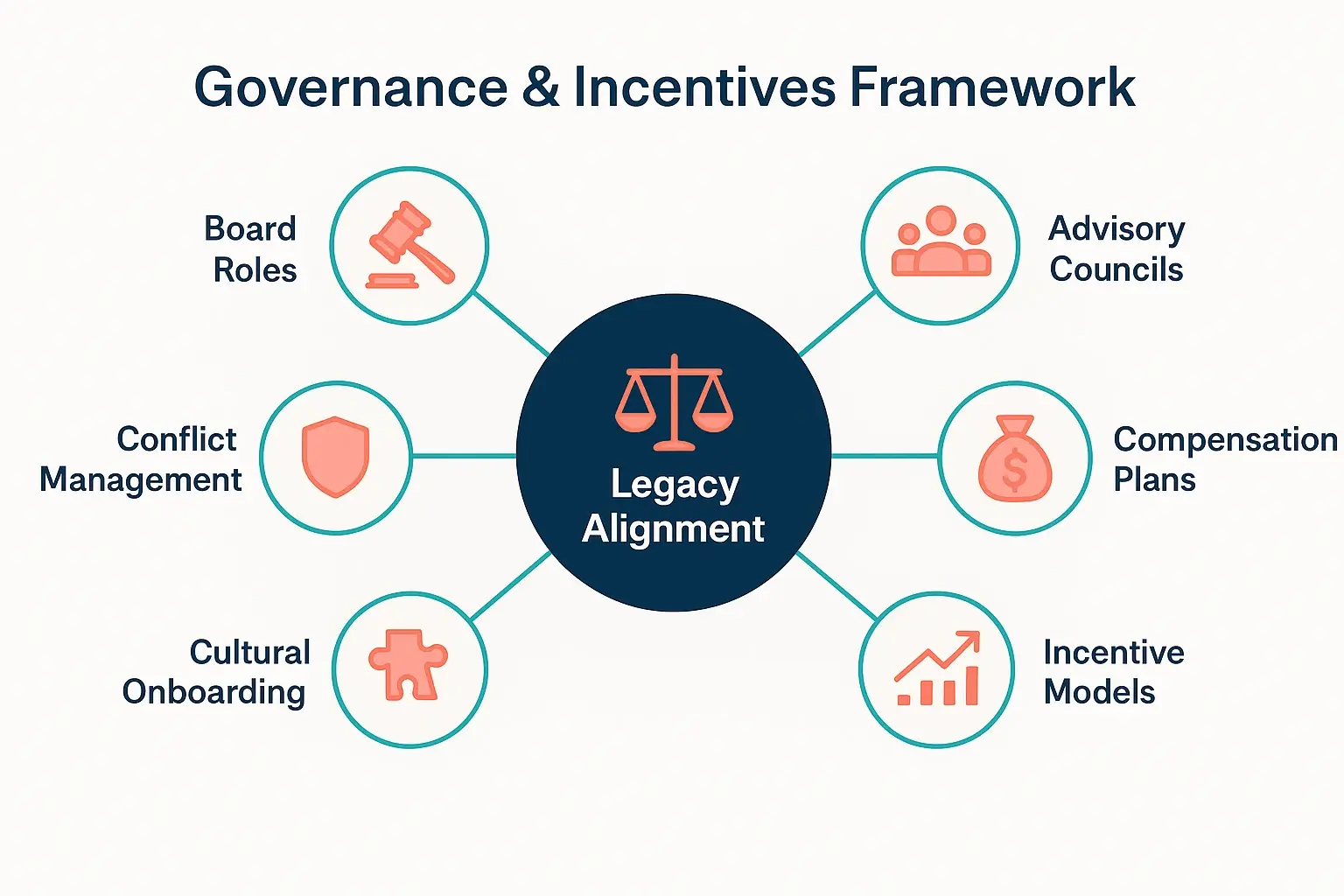

To combat this, successful organizations implement formal governance structures that give non-family leaders a voice in the legacy.

The “Hybrid” Leadership Dynamic

Managing a mix of family and non-family leaders is similar to the challenges of coaching and motivating in hybrid workplaces. In a hybrid office, you bridge the gap between remote and in-person workers; in a family business, you bridge the gap between “family logic” (emotion, history) and “business logic” (meritocracy, profit).

Effective strategies include:

- The Non-Family Advisory Board: Creating a space where non-family executives can provide candid feedback on high-level strategy without fear of stepping on emotional landmines.

- Transparent Decision Rights: Clearly defining which decisions are reserved for the family council (e.g., dividend policy, philanthropic focus) and which are the domain of the C-suite (e.g., market expansion, R&D).

Phase 3: Incentivizing the Long View

If you want non-family executives to care about the company’s status ten years from now, you cannot compensate them solely on this year’s results.

Standard executive compensation packages (salary + annual bonus) often inadvertently encourage short-termism. In contrast, family legacy is inherently long-term. To align these horizons, leading family firms utilize creative compensation models:

- Phantom Stock & Long-Term Incentive Plans (LTIPs): These instruments mimic the value of ownership without transferring actual family shares. They reward executives for the sustained growth of the company over 5, 7, or 10 years.

- Legacy KPIs: Tie a portion of executive bonuses to non-financial metrics that matter to the family, such as employee retention, community impact, or sustainability goals.

By aligning the financial rewards with the generational timeline, you transform the executive’s mindset from “hitting the quarterly number” to “building a lasting institution.”

Empowering the “Outside” Perspective

Perhaps the most valuable contribution a non-family executive can make is the ability to ask the difficult questions that family members avoid.

In many family systems, certain topics are taboo. A skilled non-family leader, secure in their role as a Legacy Steward, can gently challenge outdated assumptions. They can help the family distinguish between tradition (the fire) and ashes (habits that no longer serve the business).

This requires a culture of psychological safety—a core tenet of the integral institute approach to organizational health. When family owners explicitly grant non-family executives the permission to challenge them, the business gains the resilience needed to adapt to changing markets while holding fast to its core values.

Frequently Asked Questions

Q: Won’t giving non-family executives too much influence dilute the family’s control?A: Not if governance is clear. Influence is not the same as control. By clarifying decision rights, you allow executives to influence strategy and execution while the family retains ultimate control over ownership and values. In fact, strong non-family leadership often protects the family’s control by ensuring the business remains financially viable.

Q: How do we handle “nepotism” concerns when family members work alongside non-family C-suite?A: Transparency is key. Non-family executives should be involved in the mentorship and evaluation of next-generation family employees. This ensures that family members are held to professional standards, which validates their position to the rest of the staff and relieves the “imposter syndrome” burden from the next generation.

Q: What if the non-family executive doesn’t “get” our family culture?A: This is usually a failure of onboarding, not intent. Cultural immersion takes time. Invite executives to family history archives, let them sit in on parts of family council meetings as observers, and encourage social bonding outside of the office. Treat culture as a learnable skill, not just an innate trait.

Q: Is it risky to share sensitive family dynamics with an outsider?A: Trust is built in stages. You don’t need to share every interpersonal conflict, but you must share the dynamics that affect business decision-making. Non-family leaders can’t navigate landmines they don’t know exist. A signed confidentiality agreement is standard, but the real protection comes from building a relationship of mutual respect.

Building the Bridge

Engaging non-family C-suite talent in legacy planning is not about handing over the keys to the castle. It is about inviting trusted architects to help you reinforce the foundations and expand the walls.

When you successfully integrate these leaders, you achieve the holy grail of family business: the professional excellence of a public company with the soul and long-term perspective of a family enterprise. It moves the organization from a family-run business to a family-anchored institution, ready to face the future with a united front.

- _ _

To explore how holistic leadership principles can transform your organization’s approach to team dynamics and legacy, visit the integral institute for further resources and insights.