There is a proverb repeated in various forms across cultures: “Shirt-sleeves to shirt-sleeves in three generations.” It speaks to the difficulty of maintaining a family legacy. The first generation builds the wealth, the second generation stewards it, and the third generation—often lacking the initial grit or context—consumes it.

For founders approaching that critical first transition—passing the torch to the second generation (G2)—the stakes feel incredibly high. You aren’t just handing over a set of keys or a stock portfolio; you are transferring your life’s work, your values, and the livelihoods of your employees.

However, the primary reason succession fails isn’t usually due to tax complications or market downturns. It fails because the transition is treated as an event—a date on the calendar when the title changes—rather than a comprehensive developmental process.

If you are currently navigating the complex waters between “parent” and “boss,” or “child” and “successor,” you likely realize that informal agreements made over Sunday dinner are no longer enough. To ensure continuity, you need a formal framework that honors the family’s history while rigorously preparing the business for the future.

The Core Distinction: Ownership vs. Leadership

Before diving into the “how-to,” we must establish a critical distinction that often trips up family businesses: the difference between ownership and leadership.

In the first generation, these two are often synonymous. The founder owns the shares and runs the daily operations. But as the second generation enters the picture, these roles must be decoupled.

- Ownership refers to the legal possession of assets and the right to benefit from profits.

- Leadership refers to the operational management and strategic direction of the company.

A child can be an owner without being a leader. Conversely, a non-family member can be a leader without being an owner. The “aha moment” for many families comes when they realize that leadership is earned through competence, while ownership is a matter of estate planning.

Blurring these lines often leads to entitlement issues or putting underqualified family members in critical C-Suite roles, which demoralizes non-family talent and endangers the business.

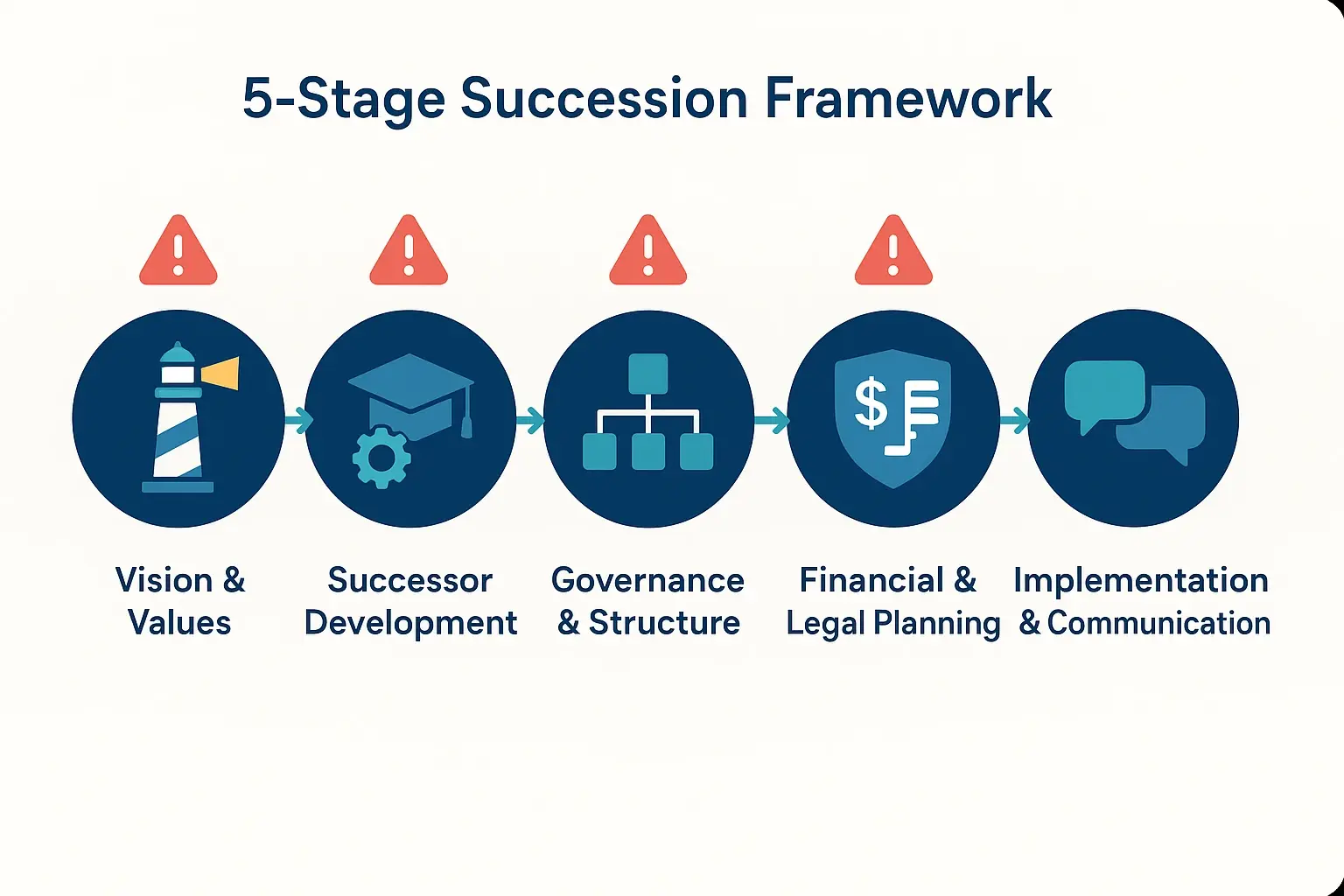

A 5-Stage Framework for 2nd Generation Succession

Successful transitions rely on structure. By adopting a formal framework, you move the conversation from emotional negotiation to strategic planning.

Stage 1: Vision and Values Alignment

Before discussing spreadsheets or tax trusts, the family must align on the “Why.” Does the second generation want to lead? Do they share the founder’s vision, or do they hope to take the company in a radically different direction?

This stage involves separating family goals (harmony, taking care of members) from business goals (growth, market share). A formalized Family Charter or Constitution often stems from these discussions, documenting the shared values that will act as the business’s North Star.

Stage 2: Successor Identification and Development

Once the vision is clear, the focus shifts to capability. This is where integral leadership becomes vital. It is not enough for the G2 successor to know the technical side of the business; they must develop the emotional intelligence, resilience, and systemic thinking required to lead people.

Best practices in this stage include:

- The “Outside Rule”: Requiring family members to work for 3–5 years in another company to gain independent perspective and credibility.

- Gap Analysis: Objectively assessing the successor’s current skills against the future needs of the CEO role.

- Mentorship: Pairing the successor with a non-family senior executive or external coach to provide unbiased feedback.

Stage 3: Governance and Structure Formalization

As the business moves from an entrepreneurial monarchy (ruled by the founder) to a sibling partnership or 2nd generation management, informal decision-making must be replaced by formal governance.

This includes establishing a Board of Directors (ideally with independent outsiders) to whom the new CEO answers. It safeguards the business, ensuring that the G2 leader is accountable to the business’s success, not just to their parents.

Stage 4: Financial and Legal Transition

This is the “hardware” of succession: estate planning, tax minimization, and share transfer mechanisms. While this requires lawyers and accountants, it should follow the strategy, not lead it. The financial structure should support the leadership plan, ensuring the retiring generation is financially secure without crippling the company’s cash flow.

Stage 5: The “Letting Go” Implementation

The final stage is the gradual handover of authority. This is rarely a switch-flip; it is a dimmer switch. It involves a phased timeline where the founder moves from “Doer” to “Manager” to “Mentor” to “Ambassador.”

The Psychological Hurdle: The Founder’s Identity

The most underestimated challenge in 2nd generation succession is the founder’s emotional journey. For many founders, the business is not just an asset; it is their identity. The thought of stepping away can feel like a loss of self.

If a founder creates a technical plan but fails to prepare emotionally for life after the presidency, they often subconsciously sabotage the successor. They might micromanage, undermine decisions in public, or refuse to vacate the corner office.

Formalizing the transition helps here. By clearly defining the founder’s new role—perhaps as Chairman of the Board—you honor their legacy while creating clear boundaries that allow the G2 leader to build their own authority.

Navigating Family Dynamics and “The Others”

In a G2 transition, you aren’t just managing the successor; you are managing the entire family ecosystem. This includes:

- Siblings not in the business: How do they feel about their brother or sister becoming the boss?

- In-laws: How do their opinions influence family gatherings?

- Non-family executives: These key employees are often the glue holding the operation together during the transition.

Integrating non-family executives into the new leadership structure is crucial. They need reassurance that the business will remain professional and that their career paths aren’t blocked by nepotism. This is where a culture of integral leadership and coaching helps bridge the gap, fostering a team dynamic that values contribution over bloodline.

Frequently Asked Questions (FAQ)

Q: When should we start planning for 2nd generation succession?A: The ideal time to start is 5 to 10 years before the founder intends to retire. This allows time for the “Outside Rule” (gaining external experience), gradual knowledge transfer, and testing the successor in roles of increasing responsibility.

Q: What if the 2nd generation isn’t ready or capable?A: This is a difficult but common reality. A formal assessment process helps identify this early. In these cases, the family might choose to retain ownership but hire a non-family professional CEO to run the business, or appoint an interim non-family leader to mentor the G2 successor until they are truly ready.

Q: How do we handle siblings who want to be involved but aren’t qualified?A: Differentiate between employment and ownership. A Family Employment Policy should set strict criteria for entering the business (e.g., specific degrees, years of external experience). Siblings can remain owners and enjoy dividends without holding operational roles that they aren’t qualified for.

Q: How do we prevent family conflict from destroying the business?A: Establish a Family Council. This is a forum separate from the business boardroom where the family discusses emotional and relationship issues. This keeps “kitchen table” drama out of professional business meetings.

Stewardship Beyond the Self

Developing a formal succession framework is an act of stewardship. It transforms the business from a personal possession into a lasting institution. By addressing the governance, the skills, and the emotions involved in the G2 transition, you aren’t just planning for a retirement party—you are designing the future stability of your family and your organization.

Succession is a journey of transformation for both the departing founder and the arriving leader. When approached with intention, clarity, and structure, it becomes the ultimate validation of the founder’s success: a legacy that thrives without them.